We had a great time attending the Reuters Insurance AI and Innovative Tech conference in Chicago last month. We learned a lot about the current state of technology and innovation in the insurance industry, especially predictive analytics for insurance.

In Deloitte’s 2022 insurance outlook report, 74% of respondents said their organizations would increase spending on AI this year, more than any other technology type. The conference sessions and my conversations with practically every attendee confirmed that investment. Insurers are going all in on AI. Most important for me was hearing about how the role of data and predictive modeling is expanding in the industry, beyond risk assessment and claims processing.

Here are some of the key takeaways from the event. In addition, we'll explain how predictive analytics can address some of the industry’s challenges today.

Tailoring the insurance experience to the customer is critical

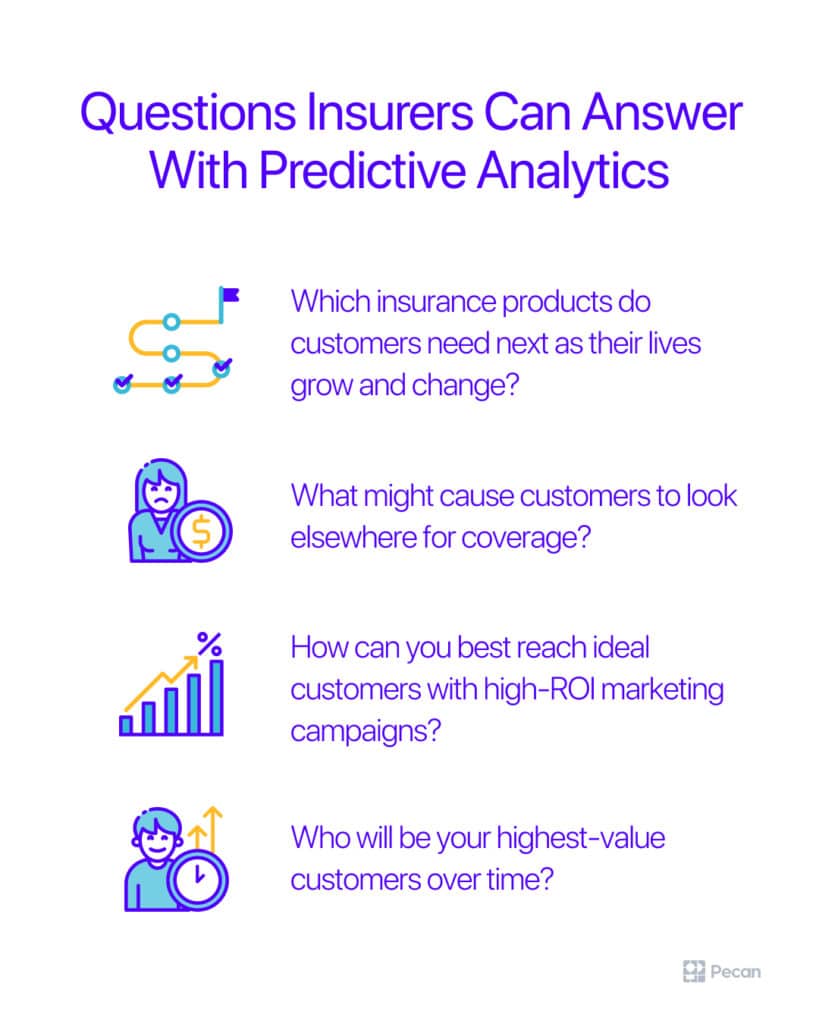

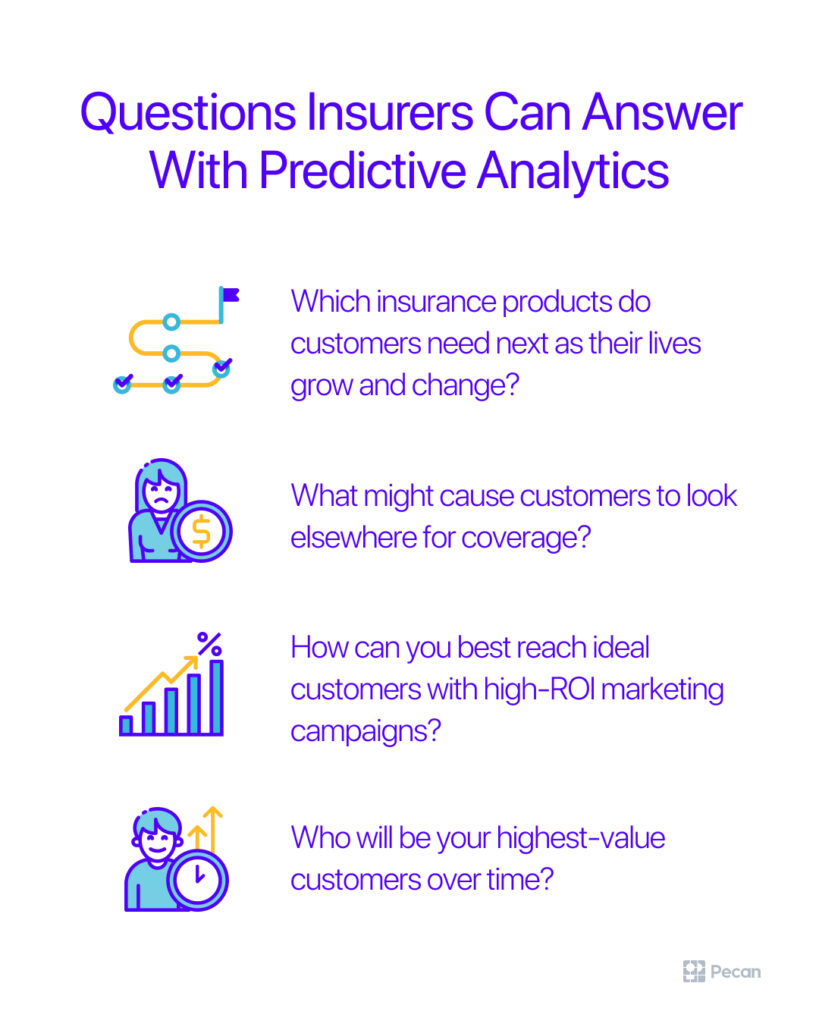

No matter what they’re buying, today’s consumers move extremely fast, so they don’t expect their needs to be simply met. Instead, their needs should be anticipated. Insurers should know what customers will want next, before they themselves are even aware.

Predictive analytics for insurance solves for these unknowns. It empowers insurers to reach out with well-timed, precisely selected offers for each customer, and increase share of wallet optimally. Insurers can proactively shape what customers feel they need from their insurer. In fact, that approach is much more effective than passively hoping customers inquire about adding products or increase coverage after seeing a TV ad or getting direct mail.

Predictive analytics is key to maintaining a competitive advantage. To be sure, that’s especially true in a consumer market that demands personalization and makes it simple for customers to shop online for insurance and switch carriers with just a few clicks.

Data governance isn’t a roadblock to predictive analytics

The topic of data governance came up often at the conference, and it’s definitely an important issue. Many insurers have started migrating their data to the cloud and adopting secure, efficient data management strategies.

Some insurers may worry that adding predictive analytics workflows into their data governance strategy would complicate an already challenging system. However, working with the right vendors makes the process straightforward, highly secure, and streamlined. In addition, it can bring tremendous benefits to the lines of business.

Some vendors (and you can probably guess which one we’d suggest) can offer strong security protections, modeling without PII, and even remote modeling in your own private cloud environment to minimize data transfers.

No black boxes here: Explainability is a must

Another common theme in Chicago was the need to understand exactly how AI models in predictive analytics for insurance make their predictions. Explainable AI, or XAI, is more than “nice to have” for insurers. It’s mandated by regulators when AI is deployed in many parts of the business.

XAI can operate on two levels. For example, in the case of a churn prediction model, it’s possible to explain 1) why each customer received a certain score for their likelihood to churn, and 2) which factors most affected the model’s predictions for all customers. Those details can determine the right outreach to each individual customer. Explanations can also shape broader decisions about marketing strategy, new policy products, and customer service.

Beyond regulatory concerns, XAI makes AI much more actionable for the business, bringing more agility to large organizations. In addition, XAI enables the design of personalized offers and products, which leads to better outcomes.

Expanding need for data science capacity across insurers’ organizations

A final theme we frequently heard at the conference was the overwhelming demand in insurance companies for data scientists’ time and expertise. Furthermore, there was a common complaint of the increased compensation and ongoing scarcity of data scientists, which make it tough to grow that capacity.

Low-code predictive analytics platforms like Pecan extend data science capabilities across organizations by enabling data analysts and business teams to build models and put predictions to work, using the skills they already have. Many feel challenged by hiring data science resources or simply can’t access internal (and overextended) data scientist teams.

To be sure, there are great alternatives that will deliver the results you’re looking for, and in a fraction of the time.

Learning more about the future of predictive analytics in insurance

We're looking forward to seeing how expanding adoption of predictive analytics will support growth and innovation in the insurance industry. There’s so much potential to achieve amazing business outcomes through hyper-granular understanding of customers’ future behavior.

Curious to know more about how predictive analytics could help you anticipate and plan forr insurance customers’ future behavior? Please let us know how Pecan can assist you in taking the next steps! We’re pumped about how predictive analytics can bring fantastic results to insurers, without requiring data science resources.

We can assess your predictive readiness with a quick, easy use-case consultation. We’ll help you find the best way to get future-ready.