Learning about annuities from TikTok. Reallocating your retirement investments with help from a chatbot. Taking a YouTuber’s advice about Social Security.

Today’s retirees probably didn’t use these methods in their retirement planning. But both younger and older generations are more than willing to use a variety of channels to learn how to finance retirement, explore their options, and take action on financial needs. And, naturally, data-powered technology will help them choose their best path forward, thanks to the growth of retiretech.

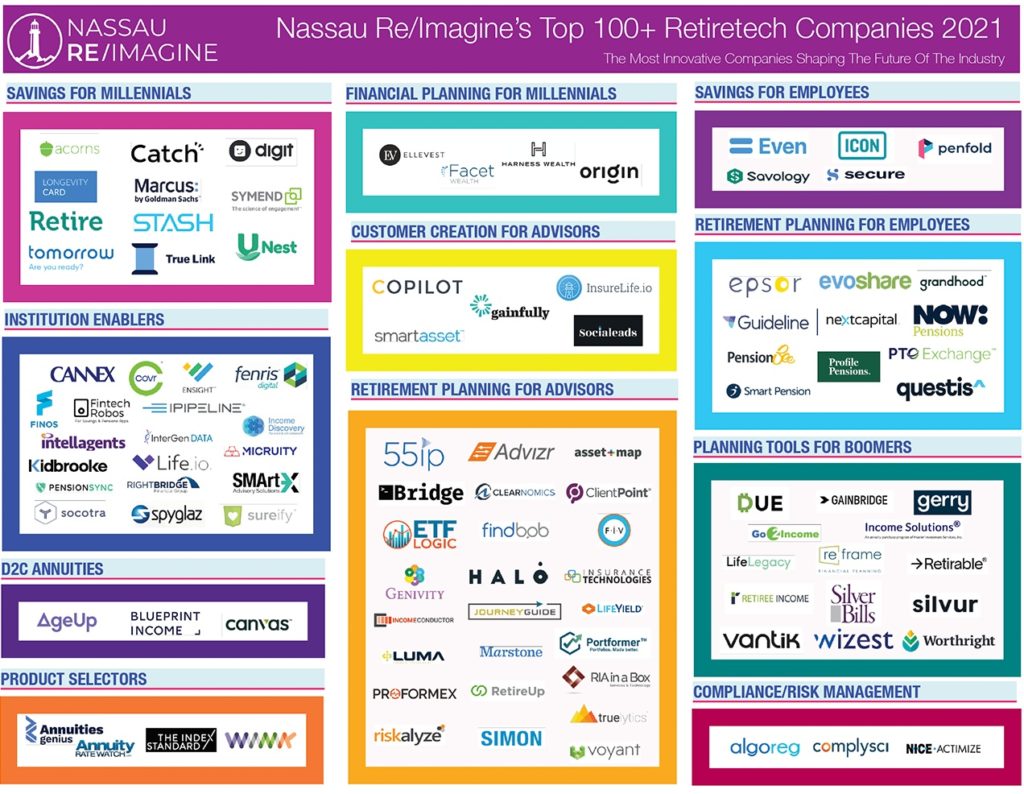

This new breed of financial innovators is developing new ways to fulfill future retirees’ financial needs and preferences. Their products include improved retirement planning offerings for annuities and health insurance products; product selectors with improved user interfaces; tools for marketing firms, millennial agents, and advisors; and much more.

These innovations were the focus of the first annual Retiretech Forum earlier this summer, hosted by Nassau Re/Imagine, Nassau Financial Group’s Insurtech incubator in Hartford, Conn. The forum brought together insurance carriers, investors, industry innovators, and startups who are collectively developing this important industry.

I learned more about these developments in a conversation with Paul Tyler, CMO at NFG, and Laura Dinan Haber, innovation program manager at NFG. We discussed the growth of retiretech and the role of data in this exciting area.

The retiretech market map by Nassau Re/Imagine

How future retirees are different

The rising generations of retirees have a different perspective on retirement. Student loan debt burdens many of them. Their savings have faltered in an unpredictable market. They’ve also witnessed their parents endure economic hardship before and during retirement.

Student loan debt was the primary reason why many millennials were behind in building up sustainable wealth. According to the study, 40% of millennial households between the ages of 28 and 38 had student loan debt that amounted to more than 40% of their income.

— CNBC, April 4, 2022

“Millennials and Gen Z are seeing that investing isn’t going as they thought it would. There’s a swath of people in their 30s and 40s who are watching their parents and realizing they’ll need something more than their 401(k)s to help them through retirement,” says Laura. “How can we engage them as early consumers?”

These younger consumers know they need to get ready for retirement, but they’re facing that challenge with a different psychological outlook and widely varying levels of financial resources.

They also bring to the task a distinctive set of shopping preferences that differ from previous generations’ habits. This rising generation of retirees has always enjoyed a personalized, 24/7 shopping experience for their everyday needs.

Growing up in the age of e-commerce and always-on communication, these consumers aren’t willing to be subject to “bankers’ hours,” nor are they interested in face-to-face financial advising. They expect their interactions with businesses to be as flexible, individualized, and convenient as any other omnichannel shopping experience.

Omnichannel demand for retirement products and services

Paul shared a story that illustrates what both younger and older retirement planning consumers seek today. He recently spoke with a customer in his 50s who started interacting with NFG through its website in the early afternoon, moved to a live chat, shifted to a phone call and talked with a representative, then texted to share further information.

By the close of business, this customer had moved nearly a million dollars into a new retirement account — all within one day.

“They want to talk to you in 3, 4, or 5 different modes of communication, and they expect that you can put all of that information together. We need to combine the data so we really know who this person is,” Paul says. “Stitching it together is a real challenge, but it’s necessary so we have consistent records and a consistent voice that offers consistent advice.”

Like marketers in other industries, retiretech providers also face the difficulty of gaining consumers’ attention in a crowded media environment. With so many communication options, the days of in-home visits with financial advisors and agents are rapidly fading.

“It’s less about sitting down with the customer across the kitchen table. Now it’s the customer saying, ‘I’m going to find you when and how I want to find you, and I expect you to be there for me,’” Laura says.

Gen Z is the most video-forward generation when it comes to learning about personal finance in particular. YouTube is the most popular source for consuming finance-related information at 45%, followed by conversations with friends and family, Internet search, TikTok, and financial information sites.

— Investopedia, August 4, 2022

NFG is experimenting with different approaches to educating the market and gaining attention for their retirement materials. One format is short-form video, which has shown promising results. Laura says that another potential strategy might include personalizing and even gamifying informative content experiences based on available data about a customer.

“It’s almost a matter of guessing ahead of time when and where they’re going to want you, and then being there with the right story to tell them,” Laura says.

How predictive analytics could support retiretech

Preserving the personal aspect of retirement and financial advising is important, but being able to streamline that process for everyone involved could also be beneficial.

Paul pointed to the potential of using predictive analytics to “turbocharge” retirement advisors’ work. Completely replacing the personal touch may be impossible. However, as in emerging “decision support” tools for health care and other fields, predictive analytics could certainly assist advisors in the task of gathering information about a client and recommending a strategy. After all, competent advising requires far more than just a financial needs analysis. It involves wide-ranging knowledge: Social Security policies, health care, long-term care, travel planning, real estate, the client’s assets, and even the client’s psychological outlook on retirement.

“Very few advisors can put all those pieces together. You either have to work with a team or have extensive expertise to make a comprehensive set of recommendations,” Paul says.

Machine learning could provide automated assistance for advisors. A machine learning model could learn from anonymized data about previous clients and the recommendations that resulted. Then, given a new client, the model could output its own suggestions for new clients that an advisor could incorporate into a personalized strategy — a “machine learning advisor for advisors,” as Paul called it.

Other potential applications for predictive analytics in retiretech might include matching clients to advisors in the first place, customizing recommendations for products and services that complement a client’s existing investments, and offering individualized messaging and educational material that’s likely to appeal to a client based on a recent online or in-person interaction.

Retiretech’s someday is here

Retiretech is a growing industry with exciting potential to transform future retirees’ financial planning, with data powering much of their reinvented experience. As these firms develop and find a foothold among the younger generations, their innovation will no doubt continue to expand. It will be exciting to see the growth of retiretech and the use of data in its advancement.

Ready to advance your company with the help of automated, accessible predictive analytics? Drop us a note to set up a quick, easy use-case consultation.